Key Cost Drivers:

- Higher prices for specialized tertiary services

- Increased utilization of pharmacy and behavioral health services

- Higher spending due to increased utilization and aging population

- Growth in high-cost therapies and more frequent million-dollar claims

- Fraud, waste, and abuse with healthcare claims, estimates of financial losses are in the tens of billions of dollars each year(4)

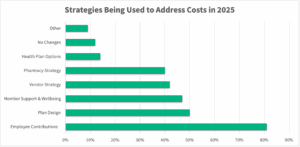

Recommended Strategies:

- Exploring alternative funding models, such as self-funded plans, to enhance cost control and transparency

- Optimizing plan design and provider networks to guide employees toward high-performance, cost-effective care

- Leveraging reporting and implementing advanced data analytics to proactively identify and mitigate emerging cost drivers

Seubert Insight: High-cost claims are not only persisting but intensifying, both in magnitude and frequency. With diverse workforce demographics, record number of insured, and increased utilization, cost control will continue to be a challenge. We help employers adopt a proactive, data-driven approach to benefits management to be better positioned to control these escalating costs while maintaining the integrity of their benefits offerings.

2. Pharmacy Cost Pressures

Pharmacy spend continues to surge, fueled by the growing use of specialty drugs and GLP-1 medications for weight management and diabetes. The 2025 PwC Medical Cost Trend report notes that pharmacy spending is now a primary contributor to overall healthcare cost increases(1).

A recent Reuters report (2025) also highlights that employers anticipate healthcare costs per employee to rise approximately in 2025-26, with pharmacy, particularly specialty and GLP-1 drugs, as a key cost driver(5).

Key Cost Drivers:

- Escalating costs associated with specialty biologics and GLP-1 therapies

- Rising utilization without clear, long-term financial planning and containment

- Unpredictable, expensive specialty drug claims that complicate budget planning

Recommended Strategies:

- Tightening formulary management and strengthening prior authorization protocols

- Promoting biosimilar adoption to reduce drug costs

- Negotiating transparent Pharmacy Benefit Manager (PBM) contracts to gain better pricing visibility and control

- Utilization and network management

GLP-1 Weight Loss Drugs: Key Options for Employers

Employers facing the rising costs of GLP-1 weight loss drugs generally have four strategic options:

- Exclude Coverage:

Opting not to cover GLP-1s, though some carriers may require excluding all weight loss treatments, including bariatric surgery. - Cover with Weight Management Program:

Require participation in a structured weight management program as part of authorization. Employers should weigh the impact on rebates, the program’s cost, and its potential ROI. - Cover with Standard Prior Authorization:

Align with industry standards requiring documented engagement in diet and exercise, a BMI at/above a defined threshold, and the presence of comorbidities. - Cover Without Prior Authorization:

Offer open access but accept the associated cost and risk.

Additional Considerations:

- Employees increasingly expect access to these treatments.

- Sometimes, cash pricing may be more favorable than the insurance-negotiated rate.

- Plans should evaluate if members are on the most appropriate medication for their biochemistry, or if alternative, non-GLP-1 medications might be effective.

Seubert Insight: A well-defined, strategic approach to pharmacy benefits is essential for cost management. Employers implementing transparent PBM contracting, clinical oversight programs, and targeted formulary management are seeing measurable impacts on their pharmacy spend without compromising care quality. Continued evaluation of options around GLP-1 weight loss drugs considering new costs, uses, and demand associated with them.

3. Holistic Wellness, Behavioral & Mental Health

Employee well-being strategies have evolved to support a more whole-person, holistic approach that integrates physical, mental, emotional, and financial health. Mental health particularly continues to be a major focus with employers looking to enhance access and support due to increased demand for these services.

Emerging Trends:

- Elevated demand for behavioral health and mental health services

- Expansion of virtual therapy options, Employee Assistance Programs (EAPs), and financial wellness initiatives

- Growth of integrated care models, including on-site support and inclusive benefits that address diverse employee needs

Organizational Benefits:

- Enhanced employee engagement, satisfaction, and productivity

- Reduced long-term healthcare claims through prevention and early intervention

- Improved talent recruitment and retention in a competitive marketplace

Seubert Insight: Investing in holistic, whole-person well-being isn’t just the right thing to do, it’s smart business and leads to improved well-being and productivity. Mental and behavioral health are closely linked to broader medical conditions and utilization, affecting cost trends and productivity. A comprehensive wellness approach yields tangible financial and cultural benefits.

4. Chronic Condition Management

Chronic conditions such as MSK, cancer, diabetes, and cardiovascular diseases remain among the top drivers of healthcare costs. According to the Centers for Disease Control and Prevention (CDC), the U.S. has the highest rate of adults with more than one chronic condition with 6 in 10 adults having at least one chronic condition, significantly impacting both healthcare spending and workforce productivity(3). On top of healthcare costs, other direct costs such as absenteeism, disability claims, and lost productivity put employer financial losses in the hundreds of billions.

Innovative Solutions:

- Employing regenerative medicine options like Regenexx for non-surgical MSK treatments

- Implementing personalized care plans tailored to manage chronic diseases effectively

- Prioritizing early intervention strategies and wellness incentives to mitigate long-term costs

Seubert Insight: Effectively managing chronic conditions is essential to curbing healthcare costs and enhancing employee well-being. Proactive, personalized care management not only improves health outcomes but also reduces the financial impact of chronic disease progression. Rethinking how to better serve employees with chronic conditions and creating solutions that work better and engage more people will impact costs in the short, and long-term.

Final Thoughts

Successfully navigating today’s benefits environment requires a forward-looking, strategic approach grounded in data, transparency, and personalization. Employers that prioritize these elements will be better equipped to sustain competitive, cost-effective benefits programs.

At Seubert & Associates, Inc. we collaborate with employers to develop tailored solutions that address these evolving challenges with confidence and clarity.

Interested in learning how these trends might impact your organization? Let’s start the conversation.

Sources

1 – Business Group on Health and PwC, “2025 Medical Cost Trend Report,” May 2025

2 – Health Affairs, “Employer Healthcare Spending Growth Expected to Accelerate through 2030,” May 2025

3 – Insurance Business Magazine, “Healthcare costs climb as pressure mounts on employers and insurers,” February 2024

4 – National Health Care Anti-Fraud Association, “The Challenge of Health Care Fraud,” 2024

5 – Reuters, “Many U.S. employers plan to pare health benefits as weight-loss spending soars,” July 2025

6 – CDC, “About Chronic Diseases,” 2024

7 – National Council on Aging, “The Top 10 Most Common Chronic Conditions in Older Adults,” 2024

Contact Michael to see how you could minimize risk.

Michael Stevenson | 412.498.6292 | [email protected] | LinkedIn

- |

- |

- |

- |